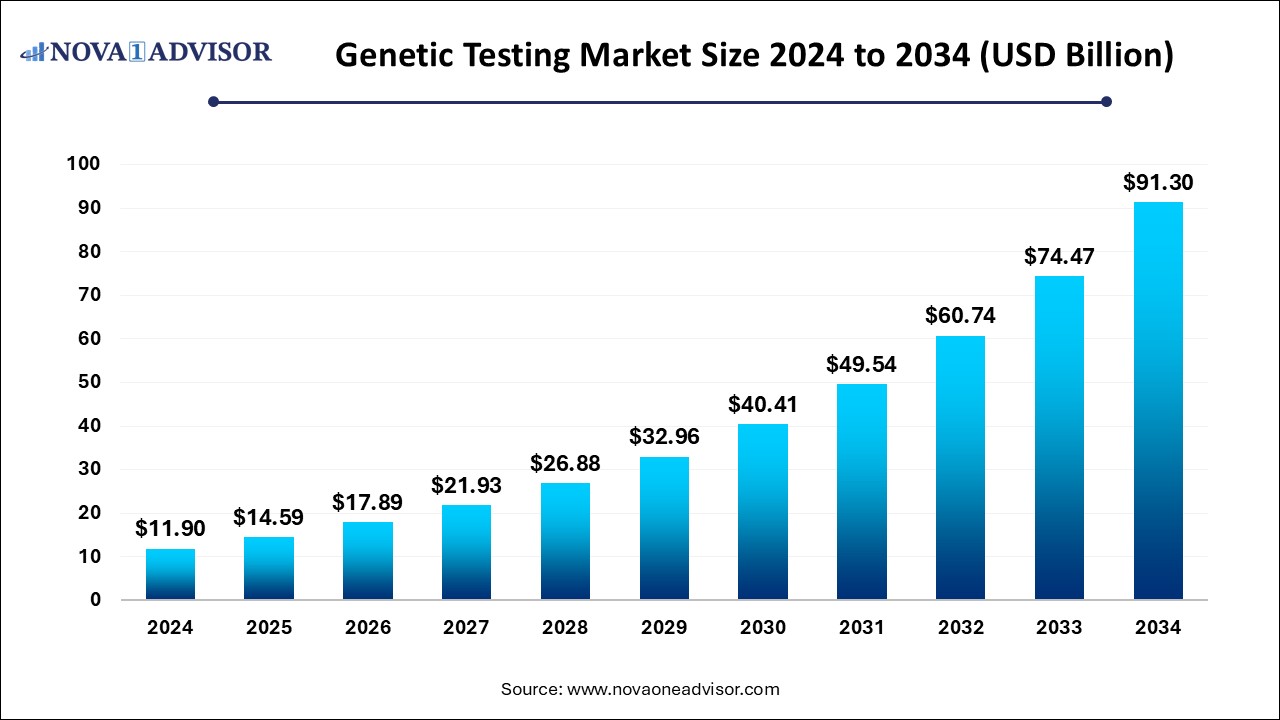

Genetic Testing Market Size to Surpass USD 91.30 Billion by 2034

According to Nova One Advisor, the global genetic testing market size is calculated at USD 14.59 billion in 2025 and is expected to surpass around USD 91.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 22.6% over the forecast period 2025 to 2034. A study published by Nova One Advisor a sister firm of Precedence Research.

Ottawa, Nov. 10, 2025 (GLOBE NEWSWIRE) -- The global genetic testing market size is calculated at USD 11.90 billion in 2024, grows to USD 14.59 billion in 2025, and is projected to reach around USD 91.30 billion by 2034, growing at a CAGR of 22.6% from 2025 to 2034. The market is growing due to rising demand for personalized medicine and early disease detection, along with advances in genomic technologies that make testing faster and more effective.

Genetic Testing Market Key Takeaways

- North America dominated the genetic testing market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology, the next-generation sequencing (NGS) segment led the market in 2024.

- By technology, the array technologies segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the health and wellness-predisposition/risk/tendency segment held the largest market share in 2024.

- By application, the genetic disease carrier status segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the consumables segment held the highest market share in 2024.

- By product, the software & services segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By channel, the offline segment dominated the market in 2024.

- By channel, the online segment is expected to grow at the fastest CAGR in the market during the forecast period.

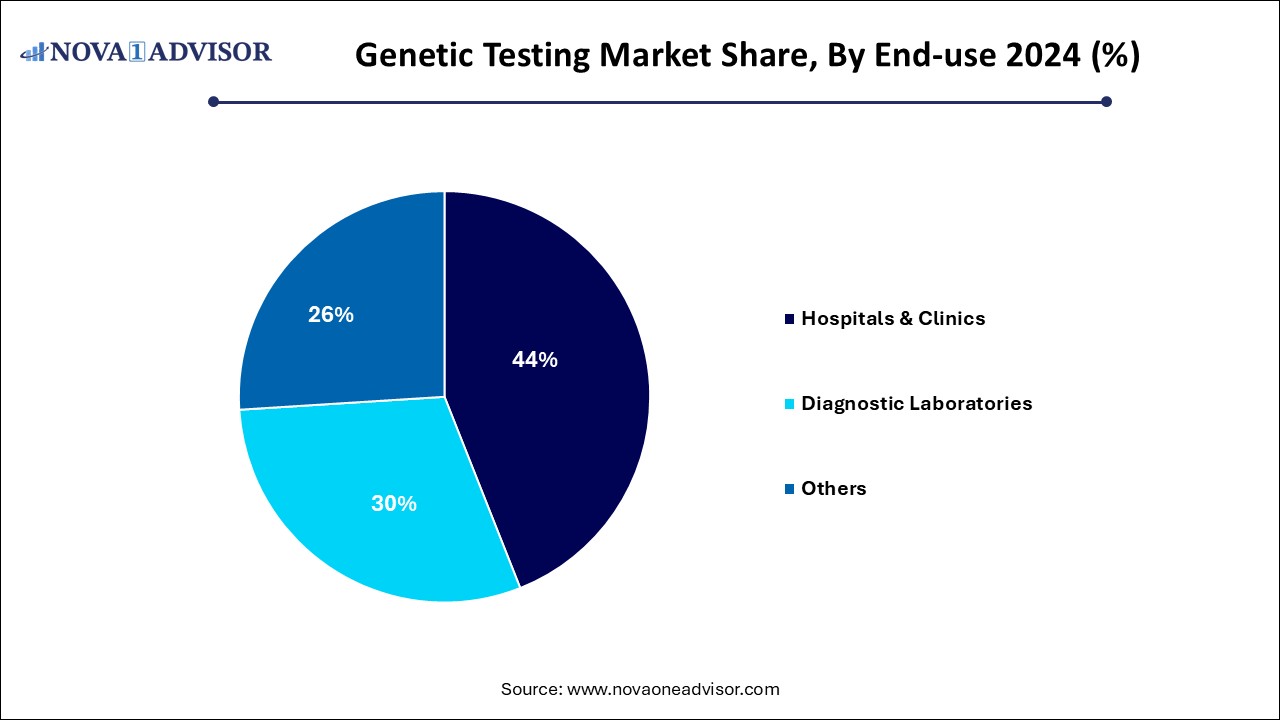

- By end-use, the hospitals & clinics segment led the market in 2024.

- By end-use, the diagnostic laboratories segment is expected to grow at the fastest CAGR in the market during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 11.90 Billion

- 2034 Projected Market Size: USD 91.30 Billion

- CAGR (2025-2034): 22.6%

- North America: Largest market in 2024

-

Asia Pacific: Fastest growing market

Download a Sample Report Here@ https://www.novaoneadvisor.com/report/sample/1028

What is Genetic Testing?

Genetic testing is the analysis of DNA to identify changes or mutations that may cause or increase the risk of diseases. The genetic testing market is expanding rapidly due to increasing awareness of personalized medicine and the benefits of early disease detection. Advances in genomic technologies, such as next-generation sequencing, have made tests more accurate and affordable. The rising prevalence of chronic and hereditary diseases, along with the growing demand for preventive healthcare, is driving adoption. Additionally, supportive government initiatives and expanding applications in areas like oncology, prenatal screening, and pharmacogenomics are further fueling market growth worldwide.

Immediate Delivery Available | Buy This Premium Research (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/1028

Genetic Testing Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 14.59 billion |

| Revenue forecast in 2034 | USD 91.30 billion |

| Growth rate | CAGR of 22.6% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2018 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Technology, Application, Product, Channel, End-use, Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Sweden ; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa. |

| Key companies profiled | 24 genetics; Circle DNA; tellmegene; 23andme; AncestryDNA; MyDNA; Everly Well; Igenomix; VitaGen; Myriad Genetics Inc.; Mapmygenome; Helix OpCo LLC; MyHeritage Ltd.; Illumina, Inc.; Color Genomics, Inc.; Amgen, Inc.; Beyond Nutrition Health and Wellness Services DMCC |

| Customization scope | Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

For more information, visit the Nova One Advisor website or email the team at sales@novaoneadvisor.com | Call us : +1 804 420 9370

What are the Primary Growth Drivers of the Genetic Testing Market?

The primary growth drivers of the market include rising demand for personalized medicine, increasing prevalence of genetic and chronic diseases, and technological advancements like next-generation sequencing. Growing awareness of early disease detection, supportive government initiatives, and expanding applications in oncology, reproductive health, and pharmacogenomics also contribute significantly to market growth.

What are the Key trends in the Genetic Testing Market in 2024?

- In June 2025, Anne Wojcicki’s TTAM Research Institute acquired 23andMe’s assets for USD 305 million, surpassing Regeneron’s bid to ensure the company’s consumer genomic data remained under her leadership.

- In April 2025, GeneDx announced plans to acquire Fabric Genomics for up to USD 51 million, aiming to enhance decentralized genetic testing with advanced AI-driven data interpretation.

What is the Appearing Challenge in the Genetic Testing Market?

An emerging challenge in the market is data privacy and security concerns related to storing and sharing sensitive genetic information. Additionally, the lack of standardized regulations, high testing costs, and limited awareness in developing regions hinder adoption. Ethical issues and misinterpretation of test results also pose significant challenges to market growth.

- For Instance, according to a 2024 survey by the American Journal of Human Genetics, about 40% of Americans expressed concern that their genetic data could be misused, particularly by insurance companies or employers.

Segmental Insights

By Technology Insights

What made the Next-generation Sequencing (NGS) Segment Dominant in the Genetic Testing Market in 2024?

In 2024, the next-generation sequencing (NGS) segment is expected to lead the genetic testing market due to its high accuracy, speed, and cost-effectiveness in analyzing multiple genes simultaneously. NGS enables comprehensive genomic profiling for personalized medicine, cancer diagnostics, and rare disease detection. Its growing adoption in clinical and research applications, along with continuous technological advancements, is driving its dominance in the market.

- For Instance, In March 2024, the Centers for Medicare & Medicaid Services (CMS) approved National Coverage Determinations (NCDs) to include Next Generation Sequencing (NGS) tests for patients with inherited cancers and solid tumors.

The array technologies segment is expected to grow at the fastest CAGR during the forecast period due to its efficiency in analyzing multiple genetic variants simultaneously at a low cost. These technologies are widely used in genome-wide association studies, pharmacogenomics, and disease risk assessment. Their increasing adoption in research, clinical diagnostics, and drug discovery, along with continuous advancements in array design, is fueling rapid market growth.

By Application Insights

How did Health and Wellness-predisposition/Risk/Tendency Segment Dominate the Genetic Testing Market in 2024?

In 2024, the health and wellness predisposition/risk/tendency segment accounted for the largest market share due to rising consumer interest in understanding genetic factors influencing overall health, fitness, and disease risk. Growing awareness of preventive healthcare and personalized wellness solutions, coupled with the availability of direct-to-consumer genetic tests, has driven demand. Additionally, advancements in genomic analysis have made such testing more accessible and reliable for health-conscious individuals.

The genetic diseases carrier status segment is projected to grow at the fastest CAGR during the forecast period due to increasing awareness of inherited disorders and the rising demand for reproductive and preconception screening. Advancements in genetic testing technologies and wider accessibility of carrier screening panels are supporting this growth. Additionally, growing emphasis on early detection and informed family planning is further boosting the adoption of carrier status testing globally.

By Product Insights

Why the Consumables Segment Dominated the Genetic Testing Market in 2024?

The consumables segment is expected to witness the fastest CAGR during the forecast period due to the frequent and repeated use of kits, reagents, and testing materials in genetic analysis. Increasing demand for high-throughput testing, advancements in next-generation sequencing, and expanding diagnostic applications are driving consumable usage. Additionally, the growing adoption of genetic testing in clinical and research settings further accelerates the need for consumables.

The software & services segment is anticipated to grow at the fastest CAGR during the forecast period due to the increasing need for advanced data analysis, interpretation, and management of complex genetic information. The integration of AI and cloud-based platforms enhances accuracy and efficiency in genomic analysis. Additionally, the rising demand for bioinformatics services and personalized medicine supports the rapid expansion of this segment.

By Channel Insights

What Made the Offline Segment Dominant in the Genetic Testing Market in 2024?

In 2024, the offline segment dominated the market due to the strong presence of hospitals, diagnostic laboratories, and specialized testing centers that offer reliable and professionally supervised services. Patients prefer offline testing for its accuracy, expert consultation, and comprehensive analysis. Additionally, healthcare providers’ established infrastructure and trust in traditional diagnostic methods contributed to the segment’s continued dominance.

The online segment is projected to grow at the fastest CAGR during the forecast period due to the rising popularity of direct-to-consumer genetic testing and increasing accessibility through e-commerce platforms. Consumers prefer online channels for convenience, privacy, and quick test availability. Additionally, growing digital health awareness, telemedicine integration, and promotional efforts by genetic testing companies are further fueling the expansion of online genetic testing services.

By End User Insights

How did Hospitals and Clinics Segment Dominate the Genetic Testing Market in 2024?

In 2024, the hospitals and clinics segment led the market due to the high volume of patient visits and the availability of advanced diagnostic infrastructure. These facilities provide accurate testing, expert genetic counseling, and integrated treatment options. Additionally, growing adoption of genetic testing for disease diagnosis, personalized treatment planning, and early detection of genetic disorders contributed to the segment’s dominant market share.

The diagnostic laboratories segment is expected to grow at the fastest CAGR during the forecast period due to increasing demand for specialized and high-throughput genetic testing services. These labs offer advanced equipment, skilled professionals, and cost-effective testing solutions. Rising awareness of early disease detection, expanding test portfolios, and collaborations with healthcare providers are further boosting the adoption and growth of diagnostic laboratories in the genetic testing market.

By Regional Analysis

How is North America contributing to the Expansion of the Genetic Testing Market?

North America dominated the market due to its advanced healthcare infrastructure, strong presence of key market players, and high adoption of innovative genomic technologies. The region benefits from significant investments in research and development, favorable government initiatives, and widespread awareness of personalized medicine. Additionally, the increasing prevalence of genetic disorders and cancer, along with comprehensive reimbursement policies, further strengthened North America’s leading position in the global genetic testing market.

How is Asia-Pacific Accelerating the Genetic Testing Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period due to rising healthcare awareness, improving diagnostic infrastructure, and increasing adoption of advanced genomic technologies. Growing populations, higher incidence of genetic disorders, and expanding government support for precision medicine are driving market growth. Additionally, affordable testing options and growing investments by international players are further accelerating the region’s genetic testing market expansion.

Some of the prominent players in the genetic testing market include:

- 24 genetics

- Circle DNA

- Tellmegen

- 23andme

- AncestryDNA

- MyDNA

- Everly Well

- Igenomix

- VitaGen

- Myriad Genetics, Inc.

- Mapmygenome

- Helix OpCo LLC

- MyHeritage Ltd.

- Illumina, Inc.

- Color Genomics, Inc.

- Amgen, Inc.

- Beyond Nutrition Health and Wellness Services DMCC

Recent Developments in the Genetic Testing Market

- In June 2025, Myriad Genetics, Inc. launched early access to its FirstGene Multiple Prenatal Screen, marking a step forward in prenatal and genetic testing innovation.

- In May 2025, Gene Solutions collaborated with NEWCL Biomedical Laboratory, Taiwan’s first LDT-certified clinical lab, to set up a cutting-edge Next-Generation Sequencing (NGS) facility in Taiwan, enhancing prenatal and oncology genetic testing capabilities.

More Insights in Nova One Advisor:

- Direct-to-Consumer Laboratory Testing Market - The global direct-to-consumer laboratory testing market size was valued at USD 3.95 billion in 2023 and is anticipated to reach around USD 9.27 billion by 2033, growing at a CAGR of 8.9% from 2024 to 2033.

- Animal Genetics Market - The global animal genetics market size was valued at USD 6,600.0 million in 2023 and is anticipated to reach around USD 13,539.2 million by 2033, growing at a CAGR of 7.5% from 2024 to 2033.

- Predictive Genetic Testing And Consumer Genomics Market - The predictive genetic testing and consumer genomics market size was exhibited at USD 4.95 billion in 2024 and is projected to hit around USD 14.97 billion by 2034, growing at a CAGR of 11.7% during the forecast period 2024 to 2034.

- Direct-to-Consumer Genetic Testing Market - The global direct-to-consumer genetic testing market size was exhibited at USD 1.94 billion in 2023 and is projected to hit around USD 17.36 billion by 2033, growing at a CAGR of 24.5% during the forecast period of 2024 to 2033.

- In Vitro Toxicology Testing Market - The global in vitro toxicology testing market size is calculated at USD 34.75 billion in 2024, grow to USD 38.64 billion in 2025, and is projected to reach around USD 100.37 billion by 2034, growing at a CAGR of 11.19% from 2025 to 2034.

- Hemato Oncology Testing Market - The global hemato oncology testing market size is calculated at USD 4.55 billion in 2024, grow to USD 5.15 billion in 2025, and is projected to reach around USD 15.72 billion by 2034, growing at a CAGR of 13.2% from 2025 to 2034.

- Drug Testing Market - The global drug testing market size was valued at USD 14.35 billion in 2024 and is anticipated to reach around USD 24.05 billion by 2034, growing at a CAGR of 5.3% from 2025 to 2034.

- Point Of Care Infectious Disease Testing Market - The global point of care infectious disease testing market size is expected to be worth around USD 19.49 Billion by 2034 from USD 12.55 Billion in 2024, growing at a Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period from 2025 to 2034.

- U.S. Eye Care Services Market - The U.S. eye care services market size was exhibited at USD 54.85 billion in 2024 and is projected to hit around USD 122.76 billion by 2034, growing at a CAGR of 8.39% during the forecast period 2025 to 2034.

- U.S. Veterinary Oncology Diagnostics Market - The U.S. Veterinary Oncology Diagnostics Market size was exhibited at USD 993.25 million in 2024 and is projected to hit around USD 2,260.25 million by 2034, growing at a CAGR of 8.57% during the forecast period 2025 to 2034.

- D-dimer Testing Market - The D-dimer testing market size was exhibited at USD 1.95 billion in 2024 and is projected to hit around USD 3.06 billion by 2034, growing at a CAGR of 4.6% during the forecast period 2024 to 2034.

- Cell And Gene Therapy Bioanalytical Testing Services Market - The Cell and gene therapy bioanalytical testing services market size was exhibited at USD 541.25 million in 2024 and is projected to hit around USD 1,107.26 million by 2034, growing at a CAGR of 7.42% during the forecast period 2025 to 2034.

- Pharmaceutical Analytical Testing Outsourcing Market - The global pharmaceutical analytical testing outsourcing market size was exhibited at USD 9.25 billion in 2024 and is projected to hit around USD 21.5 billion by 2034, growing at a CAGR of 8.6% during the forecast period 2025 to 2034.

- Home Care Testing Market - The home care testing market size was exhibited at USD 10.70 billion in 2024 and is projected to hit around USD 26.20 billion by 2034, growing at a CAGR of 9.37% during the forecast period 2024 to 2034.

-

Bioburden Testing Market - The Bioburden Testing Market size was exhibited at USD 1.75 billion in 2024 and is projected to hit around USD 6.9 billion by 2034, growing at a CAGR of 14.7% during the forecast period 2025 to 2034.

Genetic Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Nova One Advisor has segmented the global genetic testing market

By Technology

- Next Generation Sequencing

- Array Technology

- PCR-based Testing

- FISH

- Others

By Application

- Ancestry & Ethnicity

- Traits Screening

- Genetic Disease Carrier Status

- New Baby Screening

- Health and Wellness-Predisposition/Risk/Tendency

By Product

- Consumables

- Equipment

- Software & Services

By Channel

- Online

- Offline

By End-use

- Hospitals & Clinics

- Diagnostic Laboratories

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/1028

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Our Trusted Data Partners

Towards Chemical and Materials | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | Towards Chem and Material

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 420 9370

Email: sales@novaoneadvisor.com

For Latest Update Follow Us: LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.