Starch Derivatives Market Size to Worth USD 148.33 Billion by 2035 | Towards FnB

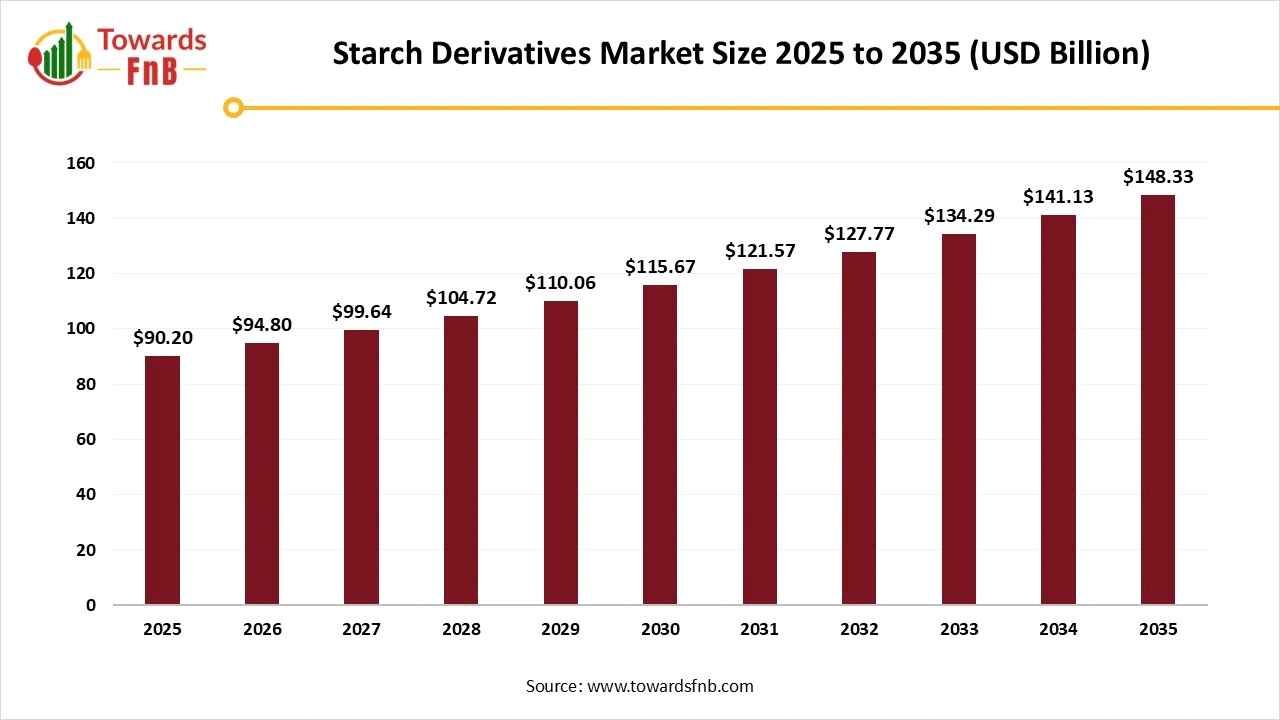

According to Towards FnB, the global starch derivatives market size is calculated at USD 94.80 billion in 2026 and is expected to reach USD 148.33 billion by 2035, registering a CAGR of 5.1% during the 2026 to 2035 forecast period. This growth is reflective of the increasing adoption of starch derivatives across a range of industries, including food, beverages, pharmaceuticals, and packaging solutions.

Ottawa, Feb. 03, 2026 (GLOBE NEWSWIRE) -- The global starch derivatives market size stood at USD 90.20 billion in 2025 and is predicted to grow from USD 94.80 billion in 2026 to reach around USD 148.33 billion by 2035, as reported by Towards FnB, a sister firm of Precedence Research. The projected growth is driven by advancements in production technologies, increasing demand for plant-based ingredients, and the versatility of starch derivatives in both edible and non-edible applications.

The market is expected to grow due to higher demand for starch-based ingredients in various domains, including cosmetics, food and beverages, pharmaceuticals, and eco-friendly products, which will further fuel market growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5876

Key Highlights of the Starch Derivatives Market

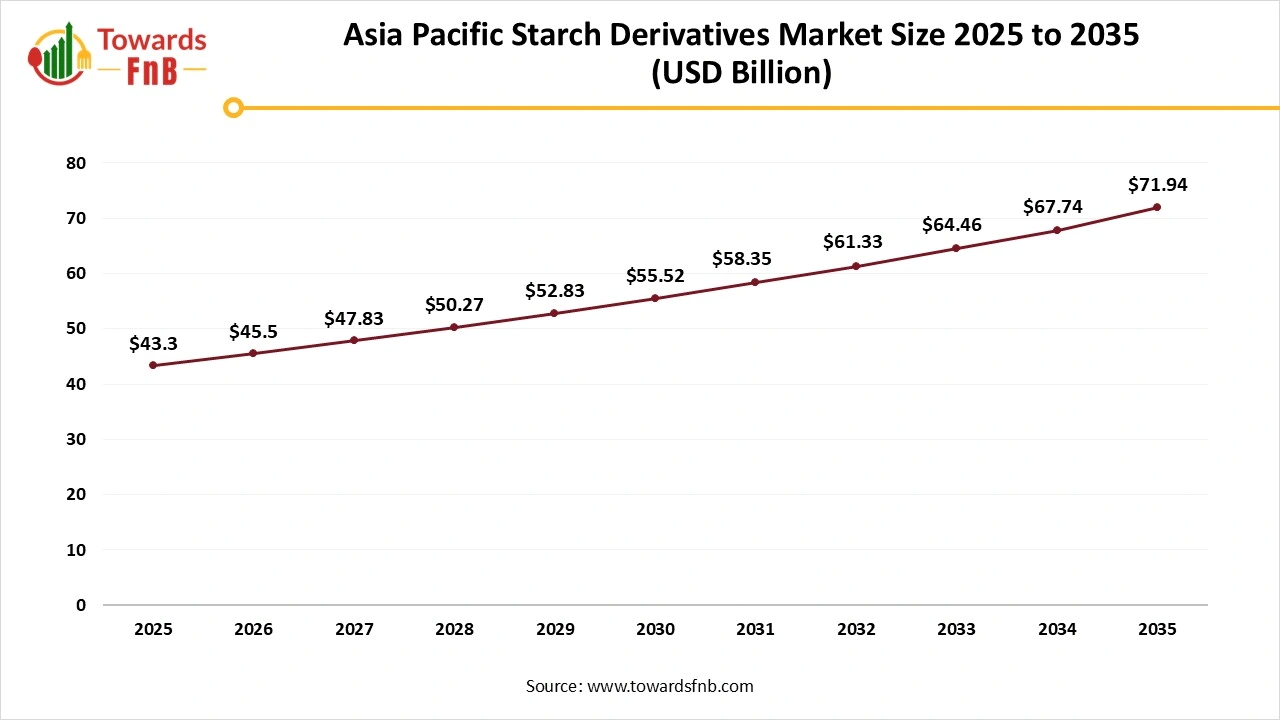

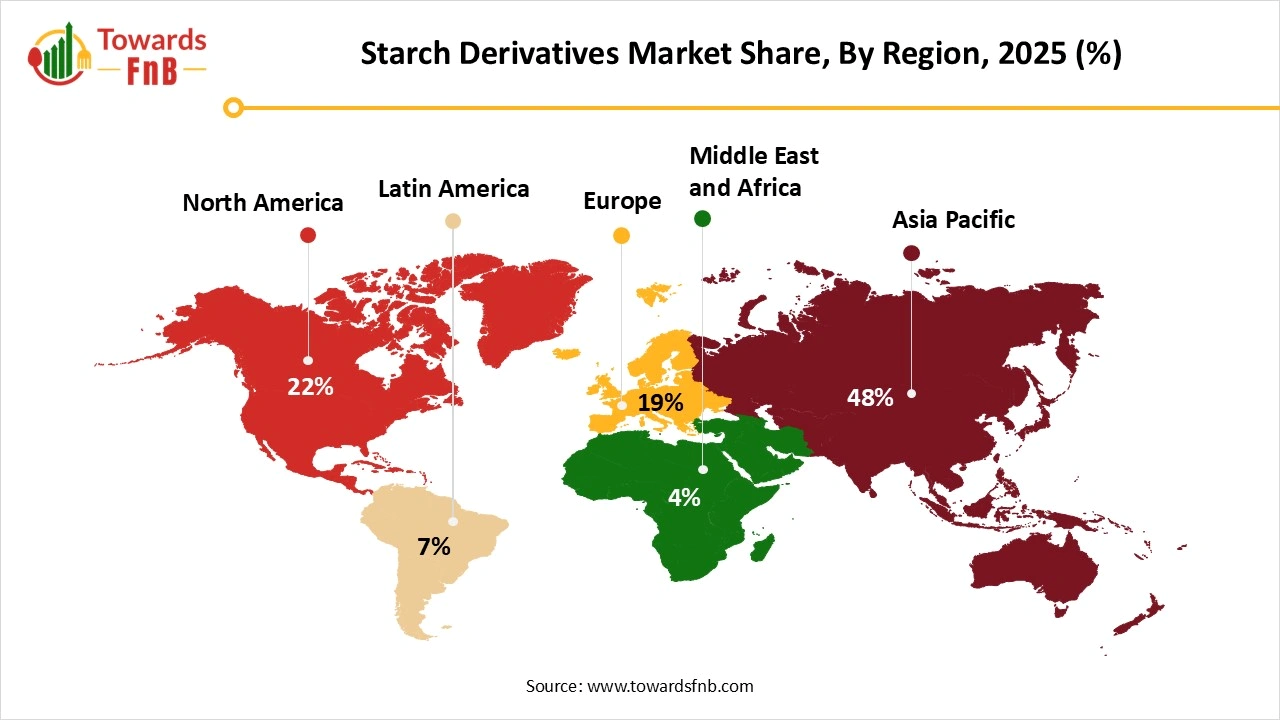

- By region, Asia Pacific dominated the global starch derivatives market with a revenue share of 48% in 2025, while North America is expected to experience the fastest growth during the forecast period.

- By product, the glucose syrup segment held a major market share of 35% in 2025, whereas the modified starch segment is projected to grow at a CAGR between 2026 and 2035.

- By source, the corn/maize segment accounted for a significant 62% of market revenue in 2024, while the cassava/tapioca segment is expected to grow at a CAGR between 2026 and 2035.

- By function, the sweetening segment held a major market share of 37% in 2025, while the fat replacer and texture modifier segment is expected to see steady growth between 2026 and 2035.

- By application, the food and beverages segment contributed 56% to the market revenue in 2025, whereas the pharmaceuticals and nutraceuticals segment is projected to grow at a CAGR between 2026 and 2035.

- By form, the liquid/syrup segment held a major market revenue share of 59% in 2025, while the dry/powder segment is expected to grow at a CAGR between 2026 and 2035.

Rising Applications Fueling the Growth of the Starch Derivatives Industry

The starch derivatives market is expected to grow due to the growing food and beverages industry and higher consumer preference for organic and plant-based options for enhanced sustainability. The industry also observed growth due to its versatility, leading to the demand for the ingredient in various edible and non-edible domains such as food and beverages, textiles, paper manufacturing, pharmaceuticals and nutraceuticals, and many other industries, further helping the growth of the market.

Technological Advancements are helpful for the Growth of the Starch Derivatives Market

Technological advancements in the starch derivatives industry involve the rise of clean-label and bio-based modifications with the help of enzymatic and nanotechnology processes. The technologically advanced procedure helps to create allergen-free, non-GMO, and natural ingredients helpful for the growth of the market. Advanced techniques such as physical treatments, improved extraction, and AI-powered optimization are another major factor fueling the growth of the market.

Impact of AI in the Starch Derivatives Market

Artificial intelligence is increasingly being deployed across the global starch derivatives market to enhance process efficiency, functional precision, and consistency across food, beverage, paper, textile, and industrial applications. Machine learning models analyze variability in starch feedstocks such as corn, wheat, cassava, and potato to predict conversion behavior during physical, enzymatic, and chemical modification processes, enabling more accurate control over viscosity, gelatinization temperature, and stability profiles. In product development, AI supports rapid screening of modified starches by modeling performance under different shear, pH, and thermal conditions, which is critical for applications requiring specific thickening, binding, or film-forming properties.

AI-driven process control systems monitor parameters such as reaction time, moisture content, temperature, and substitution levels to reduce batch-to-batch variability and improve yield efficiency at scale. AI is also applied in application-specific optimization, where predictive analytics help align starch derivative functionality with end-use requirements across diverse processing environments and regional manufacturing standards. From a quality and regulatory perspective, AI assists in specification harmonization, contaminant risk screening, and labeling alignment by mapping product attributes against international food safety and industrial use frameworks referenced by the Food and Agriculture Organization and the Codex Alimentarius Commission.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/starch-derivatives-market

Recent Developments in the Starch Derivatives Market

- In December 2025, the shares of Gujarat Ambuja Exports Limited surged over five percent in December 2025, after the company’s announcement that it had commenced commercial production at its new maize starch-based fermentation plant located in Hubli, Karnataka.

- In October 2025, Cargill inaugurated a new corn mill plant in Gwalior, Madhya Pradesh, India, in cooperation with Saatvik Agro Processors to fulfill the growing demand of the country’s confectionery, infant formula, and dairy sectors.

New Trends of Starch Derivatives Market

- Higher demand for biodegradable options to replace harmful plastics and petrochemicals is one of the major factors for the growth of the market.

- Higher demand for clean-label ingredients and starch derivatives such as maltodextrin and glucose syrup is another major factor for the growth of the market.

- Technological advancements helpful to improve the extraction and efficiency of starch derivatives also help to propel the industry.

Product Survey of the Starch Derivatives Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Native Starch Derivatives | Physically treated starches offering basic thickening and binding functionality | Pregelatinized starches, physically modified starches | Soups, sauces, bakery products | Native starch derivative systems |

| Modified Food Starches | Chemically or enzymatically modified starches designed for stability under heat, shear, or acidity | Acetylated, cross-linked, oxidized starches | Processed foods, ready meals, sauces | Modified starch ingredients |

| Resistant Starch | Starch fractions resistant to digestion, used for fiber enrichment | RS2, RS3, RS4 types | Bakery, nutrition products, cereals | Resistant starch ingredients |

| Maltodextrins | Partially hydrolyzed starch products providing bulk and mild sweetness | DE 5–20 maltodextrins | Beverages, confectionery, sports nutrition | Maltodextrin powders |

| Dextrins | Low-molecular-weight starch derivatives used for binding and film formation | White dextrins, yellow dextrins | Confectionery, coatings, bakery | Dextrin binding agents |

| Cyclodextrins | Cyclic starch molecules used for encapsulation and stabilization | Alpha, beta, gamma cyclodextrins | Flavor protection, nutraceuticals | Cyclodextrin complexes |

| Starch Ethers | Starch derivatives offering enhanced water binding and viscosity control | CMC starches, hydroxypropyl starch | Sauces, frozen foods, dairy products | Starch ether systems |

| Starch Esters | Esterified starches providing improved emulsification and stability | Acetylated starch esters | Emulsified foods, dressings | Starch ester ingredients |

| Sweetener Starch Derivatives | Starch-derived carbohydrates used as sweeteners or bulking agents | Glucose syrups, corn syrups | Beverages, confectionery | Starch-based sweetener systems |

| Specialty Starch Derivatives | Application-specific starches designed for targeted performance | Clean-label, freeze-thaw stable variants | Premium and clean-label food brands | Specialty starch derivative formulations |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5876

Starch Derivatives Market Dynamics

What are the Growth Drivers of the Starch Derivatives Market?

Higher demand for clean-label, organic, functional, and fortified options is one of the major factors for the growth of the market. Higher usage of starch derivatives in edible and non-edible industries is another major factor helpful for the growth of the market. Higher usage in food and beverage industries, paper manufacturing, textiles, and various other industries, elevates the market’s growth. Higher demand for plant-based and sustainable options also helps to enhance the growth of the market in the foreseeable period.

Raw Material Issues Hampering the Growth of the Starch Derivatives Market

Fluctuations in prices of raw materials such as potatoes, wheat, and corn due to harsh climatic conditions, geopolitical factors, production issues, and supply chain problems are some of the major problems restraining the growth of the market. Competing industries due to the rise in prices of raw materials, especially biofuels, is another major factor impacting the growth of the market. Hence, such factors altogether may slow the growth of the starch derivatives industry.

Growing Food and Beverage Industry Fueling the Growth of the Starch Derivatives Market

The growing food and beverage industry globally is one of the major factors for the growth of the market. Higher demand for starch derivatives in the baking and confectionery segment is one of the major factors helpful for the market’s growth, as the ingredient helps to manage sweetness, texture, stability, and the shelf life of the processed and convenient bakery items, which is helpful for the market’s growth. Higher demand for plant-based, functional, and fortified options by vegans and flexitarians is another major opportunity propelling the growth of the market.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Starch Derivatives Market Regional Analysis

Asia Pacific Dominated the Starch Derivatives Market in 2025

Asia Pacific led the starch derivatives market in 2025, due to factors such as the growing infrastructure for food and beverages, rapid urbanization, higher demand for quality and efficient products, and higher demand for plant-based and sustainable options in the region. The market is also observed to grow due to the rising population of the region, leading to higher demand for sustainable, high-quality, plant-based, and efficient options, further fueling the growth of the market. China has a major contribution to the growth of the market due to growing e-commerce platforms, technological advancements, and higher demand for clean-label and high-quality products.

North America Is Observed to be the Fastest-Growing Region in the Foreseeable Period

North America is observed to be the fastest-growing region in the foreseen period due to higher demand for starch and its derivatives in edible as well as non-edible industries, fueling the growth of the market. Higher demand for sustainable, plant-based, and organic options by consumers in the region due to higher availability of plant-based ingredients is another major factor fueling the growth of the market in the foreseeable future.

Europe Is Observed to Have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth in the foreseen period due to higher demand for starch derivatives in edible as well as non-edible industries, such as in the food and beverages domain and paper manufacturing domains, fueling the growth of the market. Higher demand for ingredients such as corn, maize, glucose syrups, and maltodextrin, to enhance the product quality, texture, and sustainability, also helps to propel the market’s growth. Germany has a major contribution to the growth of the market due to the higher demand for organic, functional, and plant-based options.

Trade Analysis for the Starch Derivatives Market

What Is Actually Traded (Product Forms and HS Proxies)

- Modified starches and starch derivatives such as maltodextrin, dextrins, pregelatinised starch, and other hydrolysates — key functional ingredients used in food, textiles, adhesives, paper, pharmaceuticals, and cosmetics — are commonly traded under HS 3505 (dextrins and other modified starches). This category includes chemically or physically transformed starch products that are not simply native starch.

- Maltodextrins and starch hydrolysates (often used in processed foods, confectionery syrups, and beverage mixes) are typically declared under HS 170230 and 170290 depending on the sugar and hydrolysis level, with 17023020 widely used for maltodextrin solids in international shipments.

- Native starches (raw starch inputs like corn, potato, and tapioca) — while not derivatives per se are frequently traded alongside derivatives and classified under HS 1108, providing essential feedstock for derivative production.

- Specialised starch derivatives produced for technical applications (e.g., cyclodextrins, resistant starches) are often grouped into broader carbohydrate preparation headings when HS codes are not specific, with HS 210690 or similar used for composite food ingredient preparations.

-

Packaging materials such as sacks, fibre drums, and containers are traded under separate classifications (e.g., HS 3923) and are not counted as part of starch derivative commodity flows.

Top Exporters (Supply Hubs)

- China: A leading producer and exporter of starch derivatives (e.g., maltodextrin, modified starch) serving large markets in Asia, Africa, and Europe due to extensive processing capacity and cost competitiveness.

- United States: Major exporter of modified starches, maltodextrin, and speciality derivatives backed by strong agricultural feedstock supplies and chemical processing infrastructure.

- Netherlands and Germany: Key European exporters of starch derivatives and value-added carbohydrate ingredients, leveraging well-integrated food ingredient industries.

- Thailand: Significant exporter of tapioca starch derivatives given its dominant role in global tapioca production and processing.

-

India: Rapidly growing exporter of modified starches and maltodextrins to Middle Eastern, African, and Southeast Asian regions.

Top Importers (Demand Centres)

- European Union: Major importer of starch derivatives for use in food manufacturing, paper processing, textiles, and industrial adhesives, supported by a diversified processing sector.

- United States: Significant importer of specialised starch derivatives used in processed foods, pharmaceuticals, and technical applications.

- Japan and South Korea: Importers of high-functionality modified starches and specialty carbohydrate ingredients for use in functional foods and consumer products.

- Mexico and Brazil: Growing markets for imported starch derivatives serving beverage, confectionery, and processed food sectors.

Typical Trade Flows and Logistics Patterns

- Bulk modified starches and maltodextrins are transported via containerized sea freight from major producing regions (Asia, Europe, North America) to global industrial hubs.

- High-value speciality derivatives may be shipped in sealed bags or drums and, where urgency is a factor, by air freight to maintain supply chain continuity.

-

Regional distribution centres often consolidate shipments, undertake compliance labeling and repackaging, and distribute to food manufacturers and industrial end users.

Trade Drivers and Structural Factors

- Growth in processed foods and beverages increases demand for functional ingredients such as soluble fibres, texturisers, and sweetening agents derived from starch.

- Industrial applications (paper, textiles, adhesives, pharmaceuticals) depend on consistent supplies of modified starches with well-defined functional properties.

- Cost efficiencies in Asia make producers in China and Southeast Asia competitive exporters to global markets.

- Innovation in clean-label ingredients propels trade in speciality starch derivatives designed for performance and consumer preference.

Regulatory, Quality, and Market-Access Considerations

- Starch derivatives must comply with food additive, pharmaceutical excipient, or industrial ingredient safety standards depending on end use, including requirements for purity, functionality, and labeling.

- HS code selection (e.g., 3505 vs 170230) affects tariff treatment and documentation burden, making accurate classification critical for import clearance.

-

Import permitting and compliance checks (especially for food-grade derivatives) may require safety data and specification sheets to satisfy regulatory authorities.

Government Initiatives and Public-Policy Influences

- Agricultural and trade policies that support corn, potato, tapioca, and wheat supply chains indirectly shape the competitive positioning of starch derivative exporters.

- Public health and nutrition regulations can influence formulation trends in food applications, driving derivative use.

-

Trade facilitation agreements and tariff harmonisation (e.g., within the EU) impact the ease and cost of cross-border starch derivative trade.

Policies supporting bio-based materials and sustainability encourage innovation and adoption of starch derivatives in bio-plastics and industrial applications.

Starch Derivatives Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 5.1% |

| Market Size in 2026 | USD 94.80 Billion |

| Market Size in 2027 | USD 99.64 Billion |

| Market Size in 2030 | USD 115.67 Billion |

| Market Size by 2035 | USD 148.33 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Starch Derivatives Market Segmental Analysis

Product Analysis

The glucose syrup segment led the starch derivatives market in 2025, due to its higher usage in the food and beverage industry for the preparation of various edible options, further fueling the growth of the market. Glucose syrup is made from corn syrup and is also used as a sweetener and as a moisture-retaining agent in different types of food and beverages, such as soft drinks, candies, and baked goods, further fueling the growth of the market. The ingredient also helps to enhance the profit margin of the food and beverage industry, further fueling the growth of the market.

The modified starches segment is expected to grow in the foreseen period due to higher demand in the industrial segment, leading to a spike in the demand for consumer and industrial-based products involving different formulations. The segment also observes growth as the product is also used as an emulsifier, stabilizer, and thickening agent, helpful to maintain the viscosity and texture of products in various domains, further fueling the growth of the market.

Source Analysis

The corn/maize segment dominated the starch derivatives market in 2025, due to its beneficial properties, such as binding, texturizing, and thickening in non-edible domains, which are helpful for the growth of the market. The market is also expected to grow due to higher usage in industries for the manufacturing of products such as paper, textiles, and bioplastics with a longer shelf life, further propelling the growth of the market. Beneficial factors of the segment, such as affordability, stability, purity, and wide availability, also help to fuel the growth of the market.

The cassava/tapioca segment is expected to grow in the foreseeable period due to its beneficial properties, such as affordability, binding, high viscosity, and clarity, fueling the growth of the market. Such properties allow the segment to flourish in edible as well as non-edible industries, further fueling the growth of the market. Hence, the ingredient is utilized for the manufacturing of food products, adhesives, plastics, and pharmaceuticals, which is helpful for the growth of the market in the foreseeable period.

Function Analysis

The sweetening segment led the starch derivatives market in 2025, due to the growing population of health-conscious consumers fueling the demand for healthier and plant-based options. Helpful for the growth of the market. Hence, higher demand for clean-label ingredients, plant-based options, and functional and fortified options also helps to fuel the growth of the market. The segment has a major requirement in domains such as bakery and confectionery, sweets, and various other segments to enhance the texture, stability, and shelf life of edible food and beverage options, further fueling the growth of the market.

The fat replacer and texture modifier segment is observed to grow in the foreseen period due to the growing population of health-conscious consumers always in search of healthier alternatives. Hence, such factors lead to higher demand for healthier, plant-based, clean-label, and functional options, helpful for the growth of the market in the foreseen period. Technologically advanced methods also help to enhance the product quality, further fueling the growth of the market.

Application Analysis

The food and beverage segment led the starch derivatives market in 2025, due to higher demand for food and beverage options with natural sweetness to maintain a healthy nutritional profile. Health-conscious consumers are always in search of healthier, clean-label, organic, and functional options to maintain their health profile, further fueling the growth of the market. Starch derivatives also help to enhance the stability, texture, and shelf life of food and beverage options, further fueling the growth of the market.

The pharmaceutical and nutraceutical segment is observed to be the fastest growing in the foreseen period due to higher demand for healthier options and the growing trend of health and wellness and preventive care, fueling the growth of the market. Hence, consumers of different age segments, especially the aged section, are always in search of high-quality nutraceuticals and pharmaceuticals helpful for the growth of the market. Factors such as personalized nutrition and maintaining sustainability are other major factors helpful for the growth of the market.

End User Analysis

The liquid/syrup segment led the starch derivatives market in 2025, due to higher demand for different types of edible options fueled by the growing population globally. Hence, the segment has a major contribution in the growth of the market due to higher demand for pharmaceuticals and nutraceuticals, food and beverages, plant-based options, and sustainable options, fueling the growth of the market in the foreseeable period. Higher demand for processed and convenient options also helps to fuel the growth of the market.

The dry/powder segment is expected to grow in the foreseen period due to the convenience, easy handling, and easy management of dry options, fueling the growth of the market. Dry ingredients have a longer shelf life and are also easy to carry and transport, further fueling the growth of the market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

-

Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Strategic Impact of Leading Companies in the Starch Derivatives Market

- Tate & Lyle: Tate & Lyle is a global leader in producing starch-based ingredients such as glucose syrups and modified starches, serving the food, beverage, and industrial sectors. With a strong focus on sustainability and healthier alternatives, the company is well-positioned to benefit from the growing consumer demand for plant-based and clean-label products. Its innovations in health-oriented solutions ensure continued growth in the market.

- Roquette: Roquette, a major player in the starch derivatives market, provides a broad range of products, including glucose syrups and maltodextrins, across various industries. The company’s emphasis on sustainability and plant-based ingredients aligns well with current consumer trends, positioning it for strong growth in food, beverages, and pharmaceuticals. Roquette’s global reach and focus on functional ingredients drive its continued success.

- Tereos: Tereos is a multinational group specializing in sugar, starch, and ethanol production, known for its diverse portfolio of starch derivatives used in food, beverage, and industrial applications. The company is expanding its presence in renewable energy and eco-friendly products, making it well-positioned to capitalize on global sustainability trends while benefiting from growing demand in emerging markets.

- Avebe: Avebe specializes in potato-based starch derivatives, providing ingredients for food, pharmaceuticals, and industrial sectors. The company is committed to sustainable agriculture and continuous product innovation, which strengthens its position in the growing clean-label and plant-based food markets. Avebe’s focus on environmental sustainability and functional ingredients ensures long-term market growth.

- BENEO: BENEO, part of the Südzucker Group, offers starch derivatives derived from rice, wheat, and sugar beets, focusing on healthier food solutions such as prebiotic fibers and low-glycemic sweeteners. The company’s broad product portfolio and commitment to sustainability enable it to meet the growing demand for functional and clean-label ingredients, ensuring continued growth in global food markets.

- Emsland Group: Emsland Group is a leading producer of potato starch derivatives, catering to food, feed, and industrial applications. Its emphasis on innovation and sustainable practices positions the company to benefit from the growing demand for functional food ingredients and biodegradable alternatives. Emsland’s ability to adapt to industry trends ensures its competitive advantage in the starch derivatives market.

- Grain Processing Corporation: Grain Processing Corporation manufactures starch derivatives, including glucose syrups and maltodextrins, primarily for food, beverages, and industrial applications. Its strong presence in the North American market and ongoing focus on expanding global operations allow it to capitalize on rising demand in emerging markets while maintaining a leadership role in the U.S. food industry.

- COFCO Biochemical: COFCO Biochemical, part of the COFCO Corporation, is a leading producer of starch derivatives in China, supplying ingredients for food, beverages, and industrial applications. The company’s dominance in China, combined with its international expansion strategy, positions it to capitalize on the growing demand for starch derivatives in both domestic and global markets.

- Manildra Group: Manildra Group is an Australian-based leader in starch derivatives, producing glucose syrups and maltodextrins for a variety of industries. The company’s strong regional presence in Oceania and its focus on product innovation and sustainability allow it to capture growing demand for healthier, plant-based, and clean-label ingredients in food and beverage markets.

- Matsutani Chemical: Matsutani Chemical specializes in high-quality maltodextrin and starch derivatives, with applications in food, pharmaceuticals, and nutraceuticals. Its strategic focus on the pharmaceutical and functional food sectors, particularly in Japan and Asia Pacific, ensures continued growth in these niche markets, where demand for specialized ingredients is increasing.

- Gulshan Polyols: Gulshan Polyols produces starch derivatives such as glucose syrups and maltodextrins, with applications in food, beverages, and industrial sectors. Based in India, the company’s growing export operations to regions like the Middle East and Africa, combined with a focus on biodegradable and plant-based products, positions it for long-term growth in global markets.

- Thai Wah: Thai Wah, a leading producer of cassava starch derivatives, is known for its sustainable and eco-friendly products. The company’s strong presence in Southeast Asia, particularly in the food and beverage sector, coupled with its focus on alternative ingredients like cassava, ensures it is well-positioned to take advantage of emerging market trends in sustainable, plant-based food solutions.

Segments Covered in the Report

By Product Type

- Glucose Syrup

- Maltodextrin & Dextrins

- Modified Starches

- Acetylated

- Hydroxypropyl

- Cationic

- Crosslinked

- Cyclodextrins

- Starch-based Polyols (Sorbitol)

- Hydrolysates (Dextrose/Glucose Solids)

By Source

- Corn/Maize

- Cassava/Tapioca

- Wheat

- Potato

- Others

By Function

- Sweetening

- Thickening / Bulking

- Stabilizing / Emulsifying

- Binding / Film-Forming

- Fat Replacer & Texture Modifier

By Application

- Food & Beverage

- Pharmaceuticals & Nutraceuticals

- Personal Care & Cosmetics

- Paper & Packaging

- Textiles

- Adhesives & Industrial

- Animal Feed

By Form

- Liquid/Syrup

- Dry/Powder

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5876

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.